CAA ITIN Service

Taxpayers who are not eligible for SSN but have the US tax obligations, can apply for ITIN.

To apply for ITIN, you need:

Properly filled W7 application

A tax return (required in most cases, but not always)

To submit your ITIN package, you can EITHER:

Mail the package including original identification documents to the IRS.

Set up an appointment with an IRS agent in one of the IRS service centers.

Hire a Certified Acceptance Agent (CAA) who can verify your identity documents during the in-person meeting and submit all documents to the IRS.

A Certified Acceptance Agent (CAA) is a person or business that has been certified by the Internal Revenue Service (IRS) to assist individuals and entities that are not eligible to obtain a Social Security Number (SSN) or an Employer Identification Number (EIN) to apply for an Individual Taxpayer Identification Number (ITIN).

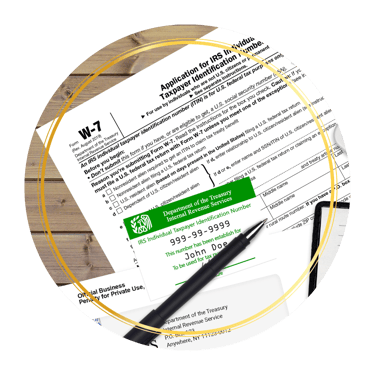

The CAA can certify original identification documents and assist with the completion of Form W-7, the application for an ITIN. They are authorized to certify copies of identification documents, and assist taxpayers in completing Form W-7 and collecting the necessary supporting documents for the ITIN application.

CAA service is available now! Check fees here

Please keep in mind, in most cases, ITIN package is mailed with the US tax return. However, there are certain exceptions to the rule.

The exceptions include:

Third-party witholding on passive income

Wages, Salary, Compensation, and Honoraria Payments (claiming tax treaties)

Third-Party reporting of Mortgage Interest

Third-Party Witholding -Disposition by a foreign person of U.S. Real Property Interest

Reporting Obligations T.D. 9363

NOTE: All ITIN exceptions require very specific supporting documentation, and approval is always subject to strict IRS review. If even one required document is missing or does not meet IRS standards, the IRS will reject the application. An ITIN will not be approved for any purpose other than tax reporting — it cannot be used to obtain U.S. credit, work authorization, Social Security benefits, or any non-tax purpose.

If you aren't located close to our office in Roseville, CA, an ITIN interview with a CAA can be conducted via video chat. Your CAA will need to hold and inspect your identification documents (usually a passport) in person. In this case, you will either have to mail an original document or a certified copy to our office. A certified copy is not the same as a notarized copy. Your foreign passport must be certified by an issuing agency in the country of origin or by your country's consulate in the USA.

W7/Document Certification by a CAA

Tax return (if needed)